Crypto Applications: Musings On Insurance Dapps (Part 1)

As many others that are spending time in the crypto space, I think a majority of the opportunity space is still at the infrastructure level as much needs to happen there to be able to scale rich decentralized applications. However a few projects in the application layer space are giving insights into what our decentralized world could look like …(digital collectibles being one)

In the space that I am focused on — financial services — one of the industries that I think will see the most change from distributed applications is insurance, especially the reinvention of mutual insurance. I have started to try to make sense on how I think about this. This is the first part of a set of posts that will look into distributed insurance solutions.

Crypto is a new form of human coordination that share some roots with Mutualism:

One way to frame the innovation shared by Bitcoin, Ethereum, Filecoin and others is that they are inventing a new form of mutualisation. The use of economic incentives to incentivize coordination is not new. After all, arguably, an important part of the coordination between humans is based on economic incentives. For example in Financial Services, it can be done via increasing economic gains (for financial services examples share companies for example) or reducing losses for its participants (mutual insurance for example). However, opting in into those schemes historically required one or multiple trusted third parties that maintained trust among all actors:

- Brokers, custodians, exchanges, market makers to guarantee the ownership, transfer of shares and liquidity.

- Mutual insurance companies to guarantee custody and management of funds, review claims and manage payouts.

Cryptoeconomic networks are unique because they are aiming to replace intermediary functions in the allocation of resources with a combination of cryptography, open source code and economic incentives:

- cryptography guarantees an open architecture by giving each participants strong identity throughout from a software standpoint

- opensource code guarantees the behavior of the intermediation software by letting anyone verify its functionalities

- economic incentive allows the networks to stay consistent in its behaviour as it grows by incentivizing maintenance functions without relying on intermediation, assuming the economic incentive model stay consistent under stress and attacks.

Coordination problems are a massive opportunity in Financial Services:

Money, Governance, Banking, Insurance, … all are coordination problems that are solved in various ways, not necessarily via economic intermediation (politics are another one). Each of these is solutions are arbitraging various factors and are by definition imperfect.

Goldman Sachs, for example, estimates that blockchain could save $11–12 billions a year in the cash securities market.

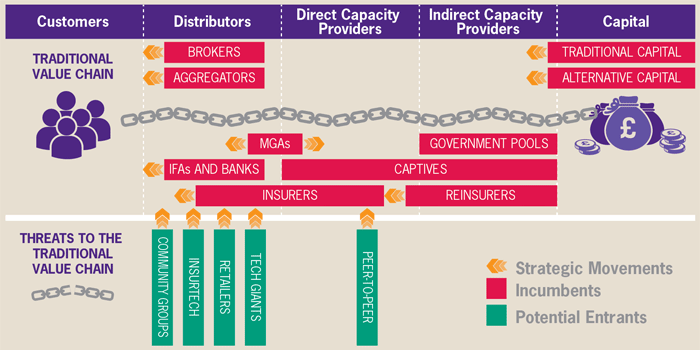

If we look specifically at insurance, it is a highly intermediated industry that offers opportunities for crypto solutions to provide a differentiated service.

In Crypto, your intermediation / trust cost is my opportunity space.

Why is Insurance a perfect fit for Dapps?

From an historical perspective:

- As a market driven approach: started and continuing with the Lloyds market < Fit for Decentralized Exchanges

- As a mutual approach: started with fire insurance in England and Benjamin Franklin in the US < Fit for Smart Contracts

- As a state driven approach: started with Bismarck on Germany < Fit for Crypto Governance

From a root function perspective:

- As a coordination problem solved by intermediation and contractualisation < Fit for Code as Intermediary

- As an incentivisation problem < Fit for Crypto Economics

- As based on a fundamental contradiction (economic incentive for paying claims) that is a source of tension in the intermediation process < Fit for Decentralization

Said differently, Insurance Distributed Applications could replace insurance companies and their balance sheet by a combination of a protocol governing the basic insurance functions from identification to underwriting and claim management, from asset management to financing and a mix of actors incentivized to perform these functions. There are however some key challenges to overcome for this to happen.

Challenges to overcome for an Insurance Dapp:

- Source of stable value: the pool of capital needs to keep a stable value vs time over time for the underwriting to work as most insurance cases involve off-chain risk that is better valued in fiat currency. In my view, stable coins are going to prove necessary for insurance dapps

- Distributed underwriting: who writes, controls and update underwriting algorithms in a distributed insurance framework

- Source of off-chain data: As trigger events appears mostly off chain, having a trusted source of information into Distributed Insurance Applications is a fundamental challenge to solve.

- Solving distributed claim management. As much as users like complain about claim management of insurance companies, the level of innovation in insurance fraud is just insane and a real problem to tackle. After all Insurance is an industry that developed lasers measurement of car dings to distinguish hail from golf ball patterns. Parametric insurance is not a silver bullet either as there has been rumors of people purposefully delaying flights to trigger a crypto-parametric flight insurance and obtain flight reimbursement.

- The R word. Insurance regulation is highly localized and provide strong entry barriers especially for B2C products. Regulation in insurance as roots from a long history of people defrauding customers by selling fake insurance products, of insolvency and of abuse of the asymmetric relation between consumers and insurance companies. It is easy to dismiss it first hand but frauds have a long tendency to bring down good actors with them.

The next post will focus on the early examples of distributed insurance applications and what they could become. More soon in Part 2. Comments, Feedback, Criticism as always welcome.