Data-Driven Energy Insurance: The Next Multi-Billion Insurtech

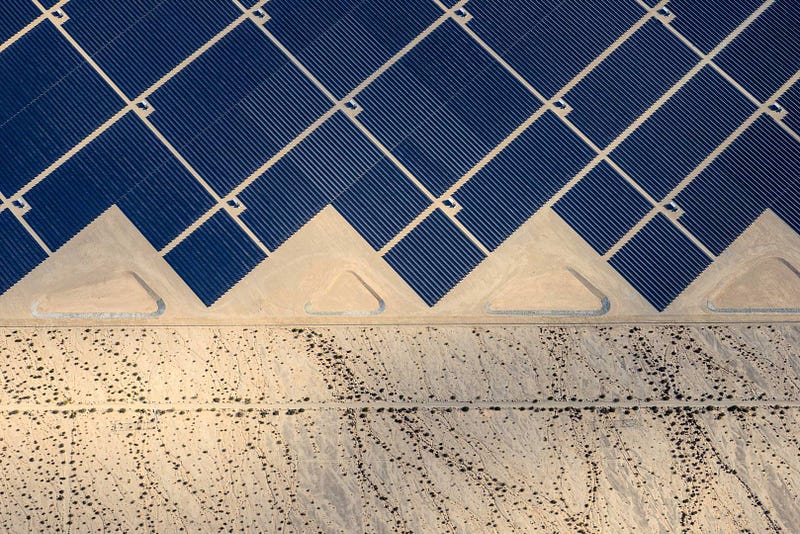

The energy industry is changing: a U.S. Energy Information Administration (EIA) report found that solar and wind accounted for nearly 95 percent of all new electricity capacity added in 2017 (15.8GW out of 16.7GW). With declining costs and increasing demand, the solar and wind industries are quickly establishing themselves as the future of energy. In the US, more than $40 billion was invested into renewable energy in 2017, and that number is expected to hit $1 trillion by 2023. Further, the growth in renewable energy financing is not just a US phenomenon, as financing globally is expected to hit $7 trillion by 2023.

As the renewable energy industry grows, so does its infrastructure. The transition toward renewables poses a significant opportunity for fintech and for insurtech in particular — and new entrants are capitalizing on it. In fact, Swiss Re Corporate Solutions forecasts that renewables will make energy insurance the “next multi-billion-dollar insurtech category.”

Financing the future of energy

The recent surge in clean energy infrastructure corresponds with a revival of cleantech venture funding. Investment in the sector totaled more than $1.7 billion from January through April 2018, a pace that could potentially reach a decade high for VC investment. Specifically, in the fintech space, renewable financing has been attracting special attention as startups have looked to build platforms to improve and expand the project financing opportunity. Direct lenders such as Open Energy Group, founded in 2013, provide capital solutions dedicated to this asset class.

Marketplace lending solutions have also developed. Clean Capital, for example, has created an investment platform for institutional and accredited investors to access high quality developers and provide underwriting evaluation and management. Crowdfunding platforms such as Wunder Capital, which has raised over $115 million, enable investments into solar projects and manage the risk by allowing investors to diversify their investment across different portfolios.

The capital-risk mismatch

A key challenge remains in the industry, which is underscored by the focus on diversification: renewable energy investments also carry specialized risks unique to renewable energy.

The renewable energy industry is uniquely positioned at the intersection of multiple risks. It combines, the traditional construction, delay, and overrun risks at the origin of the asset, the counterparty risk during the lifetime of the asset, unique risks attached to weather (how much the sun shines, how much the wind blows), and the performance of these assets over long periods of time in terms of decay and maintenance. A lack of understanding of these risks can contribute to mispricing these assets as they are considered to carry higher uncertainties in performance than they should.

In the rush to finance this new trillion-dollar asset class, an important question has emerged: Who should hold each risk? Different types of capital are naturally suited for different risks. Banks are the world’s experts in credit risk, ably accepting the risk that a certain company can become insolvent. Insurers are the world’s expert in non-credit risks, and naturally accept the risk that an individual will get into a car accident.

Further, insurers tend to be the “natural owners” of risks that have rich histories of loss, such as the risk of a solar panel failing, of the sun not shining, of power prices changing, or the battery decay profile diverging. With better access to data, actuaries can now analyze these risks. Previously, wind and solar farms lacked operating history, but there is now an outpouring of data coming from the billions of dollars of operating renewables plants. The emergence of non-traditional data creates a window of opportunity that data-driven insurers are eagerly seizing.

The data-driven future of renewable financing

The availability of data is a key driver for any financial market to find its optimal pricing. While the renewable energy industry is relatively new and may lack decades of operating history, it was also born in an era of sensors, data storage and computing power. This wealth of data has the potential to drive a new wave of energy insurance and hedging providers that help to better price the assets.

One example of a company in this market is kWh Analytics (disclosure: an Anthemis investment), which invented the “Solar Revenue Put,” an insurance contract that de-risks solar energy assets by guaranteeing a minimum level of energy output. Data enabled this innovation, as kWh Analytics manages a massive database tracking the historical performance from billions of dollars of solar farms. The company has structured nearly a dozen policies to date, insuring the cash flows on $500 million of solar assets.

Energetic Insurance also serves the solar market, focusing on the risk of non-payment from unrated or non-investment grade solar customers. By covering lost revenue resulting from customer default, such insurance policies have the potential to expand the market of solar customers.

REsurety tackles similar challenges for the wind energy market which is highly reliant on volatile wind resource. The company has created risk management tools to help bring certainty back into the equation for wind farm investors and customers, hedging the associated risks.

The energy insurance market is in its early phases, and additional investment is still needed — notably, capital is required to serve the battery ecosystem and for grid management. That said, in our view, it is inevitable that capital markets will evolve rapidly to support renewable energy, which poses a massive opportunity. Data will be at the core of the opportunity. Managing the risks of such assets, financially or operationally, will impact the success of the industry overall and usher in the new age of renewable energy.

Co-written with Jillian Williams