What is the business model for protocol companies?

Going through the various documents of the Filecoin SAFT funding, an absolute must-read for anyone interested in crypto, one answer in their Q&A touched upon how these companies will be defined and run in the future:

Normally, startup companies have many rounds, at different prices, stretched out over time. In token sales, it is usual to have a single up-front fundraising event instead, with the requirement that the team better be able to finish everything they intend to do and launch a fully functioning network. Follow-on fundraising is not solidly figured out yet. Therefore, teams raise more to be safe [my emphasis], and this increasing pricing function helps us make sure we’re selling it more fairly, instead of selling it all at the lowest price regardless of what people think it’s worth.

This question is a critical aspect of these companies. Fat protocols are closer to open source software companies than traditional companies in the sense that they give to the community most of their assets in the form of the open source code that runs the protocol. The protocol provides an incentive mechanism for its participants to operate and participate in the network in the form of tokens. Effectively they create a reduced scale economic system driven by a set of predefined parameter for its participants to live in. As a side note: the fact that they do not provide a matching political system is either a feature or a bug. See Tezos for a possible approach to this problem (if it is one).

These economic systems are not closed as they are generally kickstarted by speculation and investment in the form of an ICO / Premine. Exchanges are critical players in the process in how they support or not liquidity (the bigger / best velocity , the more symbiotic the exchange/protocol relationship is ….. or not see Coinbase /Bitcoin Cash)

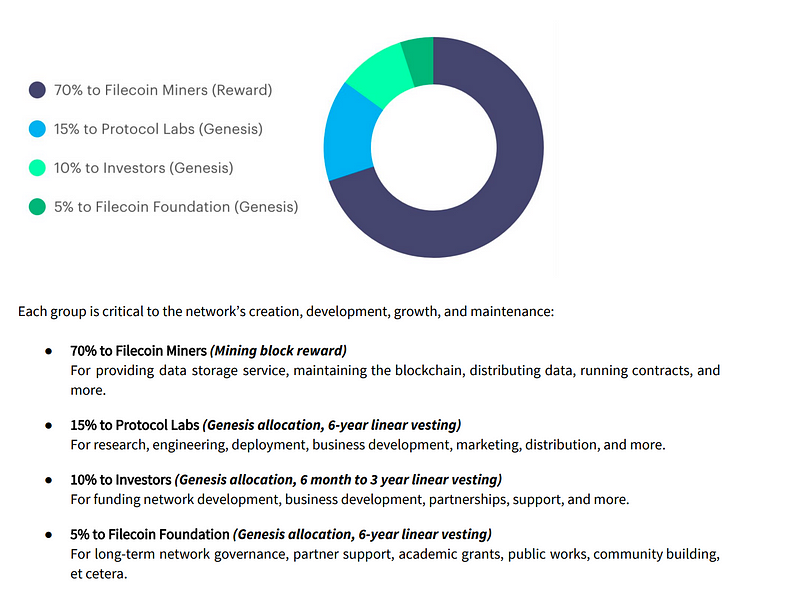

So far so good. Though something is missing in the picture: where does the protocol builder fit? The most common answer is nowhere and that’s the part of the magic (Satoshi Nakamoto has “disappeared” and Bitcoin is still functioning and growing). Protocol builder incentive is so far mostly driven by token distribution and appreciation, whether implicit (Bitcoin early contributors had more opportunity to mine and acquire Bitcoins) or explicit by reserving a set of tokens for the protocol builder in its distribution event.

This funding event, depending on its success can provide significant resources to the protocol builder but as pointed in the Filecoin ICO that’s pretty much it:

- future funding events are an important question mark as token supply is often used as critical component of protocol incentive.

- vs a more traditional company: protocol builders are most of the time not extracting any revenue from the micro economy they have built, their main driver for supporting the protocol is an increase in value of its underlying tokens vis à vis the reference currency for their cost base.

Note: This links to a critical question for VC investment in the equity of the underlying protocol companies. Without a clear revenue based business model, what valuation methodology and liquidity events should be considered?

- The most obvious solution for protocol builders is to act as an asset manager of the funds they raised. Tezos’ announcement of their diversification is an example:

The Tezos Foundation currently holds over $220M worth of bitcoins and ethers. To best serve the interests of the Tezos community, we intend to gradually diversify our position by slowly selling some (but not all) of these holdings over the coming months and purchasing a conservative portfolio of cash, stocks, bonds, and precious metals. This will ensure that our organization is resilient in good times, and bad times.

- Diversification is another solution. Protocol labs is a multiple projects company with hypothetically, some activities such as Coinlist providing ongoing revenue

- Building on-platform businesses: the analogy here would be Twitter’s move into reselling its own data firehose and removing access to some other companies (remember Datasift)? As with most analogies in the crypto space, it is imperfect. In crypto protocol, the protocol builder does not control the platform therefore should not be able to exercise any pressure to secure its control participants layer. However it is not impossible to think Protocol labs could run Storage miners or Retrieval miners or that Augur would run a Trading activity

Ultimately, whether protocol builders will be actual companies is an open question. From a transaction cost standpoint (Coase), you would expect a somewhat central entity remain at the core of the protocol code but then crypto is all about reducing transaction costs across multiple actors. One of the next critical phase of innovation for protocols is innovation on the political systems required to drive protocol change over time.