Investing in Truelayer

My first ever blog post on Tekfin, in February 2010, was entitled Impact of Free Data on Bank’s model (Part 1 and Part 2). Being an early user of Mint at a time my bank did not have an app, I was fascinated by the potential to leverage open banking data and its impact on the future of Finance. Since then, I have written extensively on the notion of banking as a platform and ownership of financial data by consumers. It is therefore a return to the roots of Tekfin to announce our investment in Truelayer.

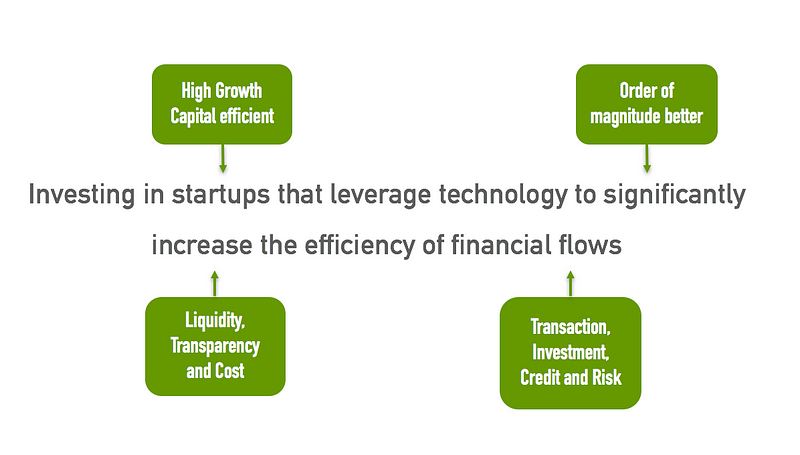

At Anthemis, our thesis is to be:

One of our deepest concerns in doing so is timing. Finding category inventors is often easier than timing their alignment with market maturity correctly.

Back to banking data, Bank APIs are nothing new conceptually and many players have been working on giving access to banking data for some time, Yodlee being the most well know name in the list. However we believe the time for Bank APIs to have a massive impact on innovation in financial services is not only now but in Europe:

- from a regulatory standpoint the combination of PSD2 and GDPR sets a unique environment for Europe to drive innovation in this field. Not only it makes access to data mandatory but it also adds the ability to go beyond a READ model and move to READ/WRITE with initiatives around payment. It also enhances the protection of consumer data by making opt-in mandatory. Note: this effectively forces banks to move in the API direction. Some of them are embracing it, others are pushing back.

- from a startup ecosystem standpoint, the number of emerging fintech and insurtech players of various sizes that have the characteristics of being both technically driven and data focused has increased exponentially. Platforms are built on power users.

- from a technology standpoint, it has moved significantly since 2010, making it possible to build more reliable platforms. Scaling data access is not a trivial problem and doing it in a way that both minimizes future technical debt as well as manages consumer level authorization is not simple.

We believe Francesco, Luca and the Truelayer team are the right ones to provide the best tech driven financial data platform for Europe. Anthemis is excited to support them by leading their Series A. In line with our thesis, we are convinced a “middleware” layer that aims to provide transparency, insights in the financial data of its users is a key driver to make financial services more efficient. If you are a company that needs access to your customer’s financial data, you should sign up for Truelayer.