SoftPOS: a driver of Embedded Finance you have (most likely) not heard about

With iOS 16, Apple is probably / maybe / finally launching Tap to Pay and, with its implementation, will ultimately make SoftPOS a reality.

SoftPOS or Software Point Of Sales allows merchants to use a phone or device as a card payment terminal without needing additional hardware. This might seems like a small change, but it has a massive impact on embedded Finance for SMEs.

To take a step back, if you have used a modern Square or Sumup device or any more traditional terminal, you have paid on an electronic/mobile POS, meaning you have used a dedicated piece of hardware for payment.

From a technical standpoint, these dedicated pieces of hardware are way less powerful than a modern smartphone. Still, from a process standpoint, they are going through a set of certifications that (should) make those trusted by actors of the payment networks. The main certifications applicable to POS hardware are PCI-PTS (PIN Transaction Security) and PCI DSS (Data Security Standard), which deal with interacting with the card Secure Element and data storage and transmission.

Since most mobile phones over the last couple of years have their cryptographic capabilities, i.e. an on-device secure enclave and the architecture for managing encrypted data in-app, it was a matter of time / changing guidelines by the payment network to allow for mobile phones to accept contactless payments directly. It has been a possibility on Android for a couple of years and will be a reality on iPhone very soon.

The Overall mobile POS market is expected to grow significantly over the coming years:

However I think SoftPOS will play an outsized role in this growth, because you now can distribute In Real Life payment acceptance in a purely digital/scalable way and more deeply integrate payment acceptance data within an application.

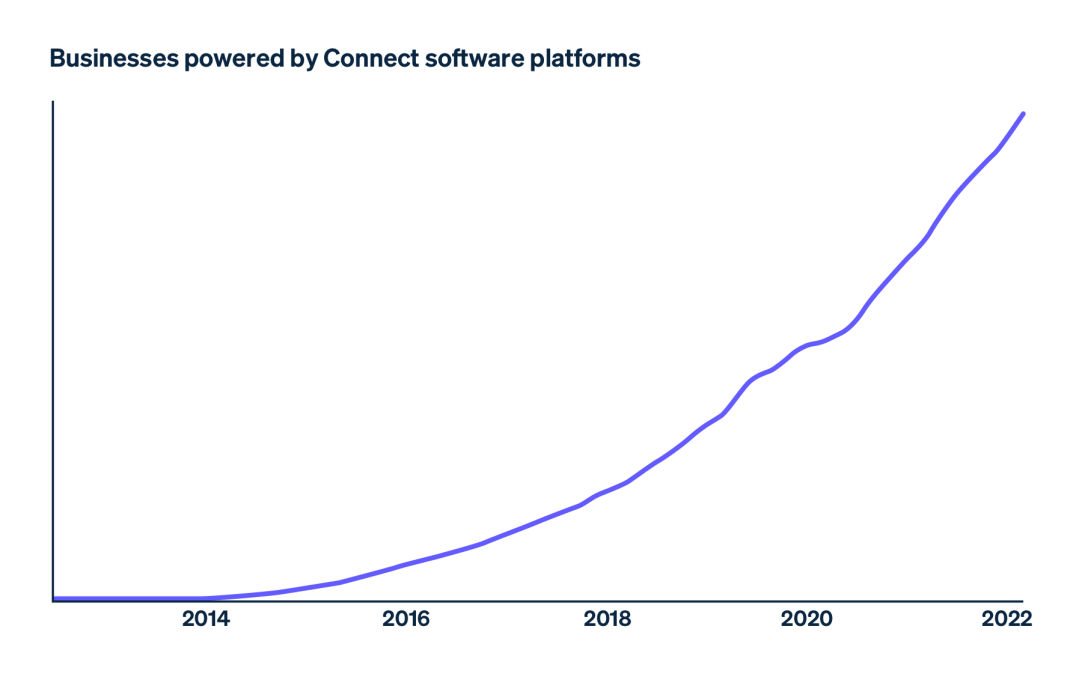

Consider the impact of Stripe, Adyen, and the modern generation of online payment acceptance solutions for developing e-commerce and SaaS solutions. Adding payment acceptance with a few lines of code and a simplified onboarding process has been the key enablers for a new generation of online solutions to be built. The growth of Stripe connect, their platform product, shows how software payment solutions have enabled a whole new set of companies.

It's no surprise McKinsey recently that SMBs are expected to spend more than $100 billion on payments services by 2025 (2021 Global Payments Report).

While the abstraction of payment from solution has fully happened in the online world, this is not the case yet in real life. Square, Sumup, for example, still blend payment acceptance and software solutions for their smaller customer base, including a whole point of sales solution. Their API integrations, aimed at larger businesses, require the procurement of hardware outside the APIs. There are, to my knowledge, no hardware-based solutions that can be made available on low volume via API integration and much less instantly.

With Software POS, it will be possible for a software solution to onboard a user instantly to accept card payments In Real Life. It opens a new set of opportunities for verticalized SaaS solutions for services businesses or any merchants acquiring payments In Real Life by fundamentally reducing the existing friction.

In addition, Software POS allows for deeper and more efficient data integration of payment acceptance within an app, for example, by linking the POS directly to a user instead of connecting the POS to a terminal device, effectively adding more granularity to the ledger of transactions and risk associated.

Loyalty schemes could also have a deeper integration within the payment process, with instant recognition of benefits and discounts. Bill splitting could be coded instantly on the app with sequential payments automatically presented or recurring payments initiated.

Without the complexity of hardware procurement, more software providers could look at the opportunity of becoming Payfac themselves and generate income from payment acceptance.

With Software POS, traditional card payments will be more easily blended within a complex payment flow, whether alternative rails, inventory management, payment split, etc...

If you are working on startups in this space or are interested in learning more about integrating SoftPOS into your software solution, reach out!