Musings on the Prosumer Video Production market

Paradoxically, for someone working mostly remote since 2011, I haven’t paid a lot of attention to the production quality of my online communications until recently. Mostly because most of calls were with people in offices, I was anyway a small vignette vs the real life interactions happening there. This has changed with Covid-19 as it has put everyone else in remote and on an equal footing in terms of medium of communications,

In parallel, having following the evolution of gaming, streaming and video content over the last 5 years, it’s difficult not to be amazed by the ramp up in video production quality recently, not only with stars but also at every level of success.

I believe the convergence with these two trends, driven by the experience design of live and online content is a massive market in the making:

- As revenue generative content creation is expanding to new platforms (like Youtube and Twitch) and new creators (like gamers, social media influencers and Youtubers), the infrastructure for content creation has started to evolve to answer the needs of amateurs and prosumers to deliver high production value anywhere and specifically from home.

- As companies become more remote protected and operate in a more distributed ways with their suppliers and customers (a trend accelerated by Covid19 but present before), the quality of online interactions is becoming increasingly important. Not only part of these interactions are shifting toward video (whether asynchronous or synchronous), but there are early signs that the quality production push seen with content creators will expand to the corporate world.

There is a massive opportunity for the companies building the tools whether hardware or software that allow anyone to produce high quality video content from anywhere.

This market is already growing fast today and splits in various categories although overlaps and convergences are increasingly relevant

- Hardware > for example Elgato (2015 revenue: $40 millions (?))

- Production / Streaming software > for example Restream ($50 million series A announced led by Saphire Ventures and Insight Partners)

- Content Properties (music, images, overlays) > for example Artlist ($48 million raise led by KKR)

How big an opportunity is it?

For emerging markets, calculating a single TAM number can be a bit of a misnomer and creates the risk of under appreciating the potential for it. Said differently, it is because the number for these markets today are not reliable or small that makes them more interesting to bet on, whether in investing or professionally for your career. However it can be helpful to triangulate a few know numbers in adjacent spaces to get a sense of high level perspective of where it could grow potentially. I have listed a few ideas below.

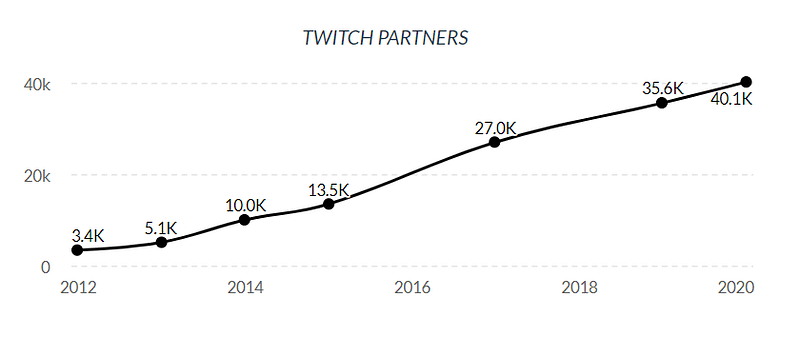

Professional Streamers and Youtubers market: the impossible stat to get. A good proxy are numbers from Twitch. Twitch Partners are the highest tier in monetization on the platform, allowing people to pay for subscription of the content.

There is also a lower tier monetization category: Twitch Associates that is most likely upward of 220k people (last known number from 2018)

Digital camera market size : $ 18.6 billions in 2017 (downward CAGR!) < https://www.researchandmarkets.com/reports/4514578/digital-camera-market-global-industry-trends

Two additional numbers to look at when assuming corporate spending will shift toward this market from established spending categories.

Business travel market size : $1,266 billions in 2016 < https://www.alliedmarketresearch.com/press-release/business-travel-market.html

Formal wear market size : $ 4.5 billions (current) < https://www.fibre2fashion.com/industry-article/5124/look-of-elegance-market-for-corporate-wear

Over the coming weeks, I will dive deeper on some of these players and trends. I will also share the how-to of my personal set up (I am finishing it now), ie dog fooding to learn more on this. If you are interested in the topic or building in this space, reach out to me!