InsurTech or CapitalTech?

There was recently a great post by Steve Evans over at Artemis on Swiss Re latest results and what they mean for the insurance industry. I encourage you to go and read it: http://www.artemis.bm/blog/2016/03/16/swiss-re-ready-to-disrupt-the-risk-to-reinsurance-capital-value-chain/

Among the many interesting points in this article, a few stood up:

There is a growing recognition, both within insurance or reinsurance and on the outside looking in, that the risk -> insurance -> reinsurance ->retrocession capital value-chain is too long and convoluted, with too many points where value is extracted by intermediation and therefore there are plenty of opportunities to disrupt this process.

At Anthemis, one of our core thesis since we started investing in Financial Services startups is that technology will have/is having a massive influence on how the traditional financial services stack is organized, driven by two main factors:

- that technology impacts transaction costs (in a Ronald Coase sense) and challenges vertical integration in banks or the role of traditional distributors / aggregators / match makers.

- that digital distribution is not a channel but an integrated part of digital services built by companies with a different skillset / mindset.

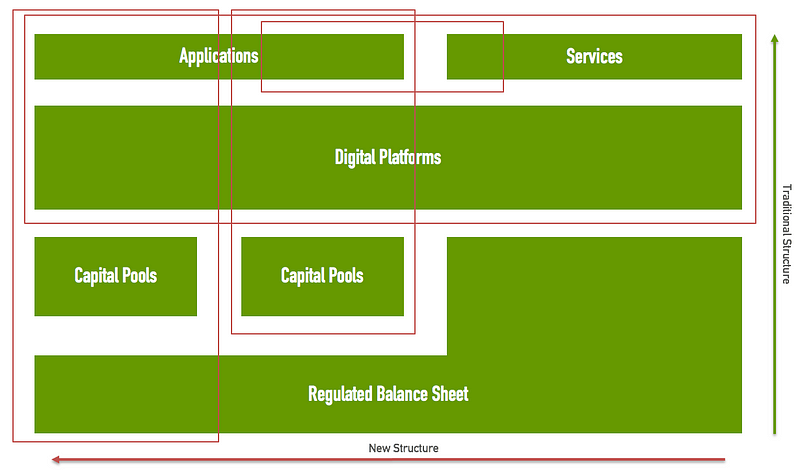

To put it visually, the historically known paths from Capital to Applications/Services are increasingly challenged by a variety of solutions.

The insurance industry is uniquely different from the banking industry in the fact that it is, at core, largely fragmented in various layers (for a discussion on geographical differences around this: https://medium.com/@tek_fin/is-the-insurance-industry-about-to-change-radically-5cf09582cff0#.3x9qifmap):

risk -> insurance -> reinsurance -> retrocession

Each has players that have historically cemented their position around their moat (the following is oversimplifying things, there are much more nuances in the skills of each player, for example the risk capabilities of reinsurers):

- Brokers by benefitting from recurring revenue after the steep working capital needs of acquisition (think Saas model effectively).

- Insurers by leveraging historical loss data incurred at capital cost to build underwriting knowledge.

- Reinsurer by growing large enough balance sheet to maintain the necessary diversification.

Enter digital technology and suddenly these moats starts to seem less important:

- Digital distribution (especially if embedded with services) challenging the nature of customer acquisition.

- Non insurance proprietary data as well as an increase in computational capabilities challenging traditional underwriting.

- Transparency and electronic markets opening the gates for more alternative capital providers looking for uncorrelated returns.

It is therefore no surprise to read in the same article:

“Swiss Re has to have access to the risks it wants to underwrite,” Kielholz explains, going on to describe initiatives such as Global Partnerships, which develops opportunities with governments and supranational institutions, and its Life Capital Partners, which accesses life risks through distribution or by buying closed-books, as examples of this trend.

We’d also add the reinsurers corporate solutions work as an example of the firm seeking to more directly access risk and more efficiently deploy its capital.

Insurtech startups have a unique opportunity to be the key players of the reorganization of the insurance industry around these new efficiencies.

Some of our key focus at Anthemis are on startups:

- that are working on making risk more granular and transparent to allow better matching to capital AND

- that are working on reducing the path from risk to capital and/or expending access for capital.

If you are building such a company, don’t hesitate to reach out.